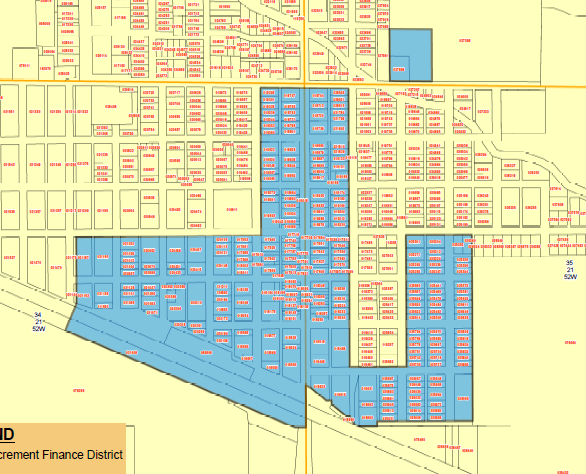

Tax Increment Financing (TIF)

In order to get Tax Increment Financing for a property, there are two processes that need to be followed (1) designating an area as blighted and substandard designation and (2) adopting a redevelopment. These processes involved three public entities—the planning board, the community redevelopment authority (CRA), and the governing body (City Council in this case). These processes and the required notifications are generally covered by the Community Redevelopment Law—Neb. Rev. Stat. § 18-2101 through 18-2144.

As set forth by Nebraska Community Development Law, Neb. Rev. Stat. 18-2101, eligible expenditures for TIF include:

1. Acquisition and site preparation of redevelopment sites including demolition, grading, environmental remediation and related work prior to construction of the project and costs associated with relocation.

2. Public improvements associated with a redevelopment project, including the design and construction of public arterial streets, sidewalks, alleys, water, sewer, street lights, the design and construction of public parking; design and installation of public streetscape amenities; and the preservation of historic facades.

See the full process in the attached PDF .

Launch the media gallery 1 player

Launch the media gallery 1 player